According to recent reports, 78% of NFL stars and 60% of NBA players file bankruptcy within 5 years of retirement. MLB Pro Baseball players file for bankruptcy four times more than the average US citizen for the same time period. This is despite the fact that the average pro athlete in the US will earn more in a single season than many of us will earn in our lifetime.

The most regrettable part is that such financial mishaps are easily avoidable with a simple strategy ANYONE, including pro athletes, can follow. Let’s begin the solowealth Cash Flow strategy:

1. Set a Financial Goal.

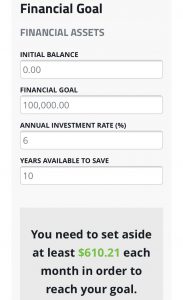

Complete STEP 2: Financial Goal of the solowealth financial plan. You can set a 1-year, 5-year, 10-year or whatever financial goal time period you like. For a simple example, let’s assume the following:

INITIAL BALANCE [The money you currently have available to put toward your financial goal]: $0

FINANCIAL GOAL [The amount of money you hope to accumulate]: $100,000

ANNUAL INVESTMENT RATE [the yearly rate of return you hope to gain from your investments. This rate will fluctuate up or down depending upon the health of the economy amongst other factors. As a general rule of thumb, advisors will typically anticipate an average 6% rate of return): 6

YEARS AVAILABLE TO SAVE [The number of years you plan to give yourself to accomplish your financial goal]: 10

Plug in these values and the solowealth Financial Goal calculator will automatically determine that “you need to set aside at least $610.21 each month in order to reach your financial goal.”

This is only an example. You can set your own financial goals according to what you can manage. Your goals cannot be accomplished unless you take this first step…no matter how small.

2. Calculate your monthly spending and determine the amount you are able to invest to reach your financial goal.

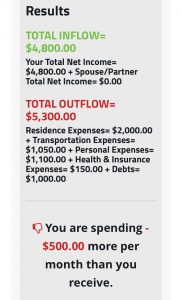

Using the STEP 3: Cash Flow calculator of the solowealth financial plan, determine your cash INFLOW (total after-tax income) and cash OUTFLOW (total expenses). Your expense categories will generally consist of:

Using the STEP 3: Cash Flow calculator of the solowealth financial plan, determine your cash INFLOW (total after-tax income) and cash OUTFLOW (total expenses). Your expense categories will generally consist of:

- Residence

- Transportation

- Personal

- Health & Insurance

- Debts

Plug in the requested MONTHLY values to the best of your knowledge and if you’re spending less than you earn, the solowealth Cash Flow calculator will automatically determine the monthly amount of money you can save to invest:

However, if you’re spending more than you earn, ie. using too much credit, the solowealth Cash Flow calculator will automatically determine the monthly amount of money you are overspending thereby preventing you from investing:

Your mission is to at least save the monthly amount needed to invest as determined by the STEP 2: Financial Goal calculator in order to reach your financial goal within your specified period of time.

If you’re unable to save enough to invest, review your monthly STEP 3: Cash Flow statement and search for financial waste. Using the previous example, we determined that you would need to save about $610, at a 6% annual investment rate of return, in order to reach your financial goal of $100,000 in 10 years. But assume the STEP 3: Cash Flow calculator determined you save only $400 per month to invest after all monthly expenses are paid. This would leave you $210 short.

Reviewing your STEP 3: Cash Flow statement find and remove any financial waste that you can then put towards this $210 shortfall. Can you find a better insurance rate? Do you have the best possible mortgage rate your broker can find? Or, maybe you’re simply spending beyond your means.

Any one of these solutions can put more money in your pocket with which to invest. Whether your financial goal requires you to save to invest $600 a month, or in the case of a pro athlete $60,000 a month, the fundamentals of the ‘game’ don’t change.

3. Separate your ‘checking’ and ‘spending’ accounts.

To manage your monthly spending, have a ‘spending’ account at one bank that is separate from your ‘regular checking’ account at another bank. Traditionally, a checking account is used to cover your ‘fixed mandatory’ expenses such as your rent or mortgage, gas, groceries, insurance, phone, utilities and so on. The problem is your ‘fun expenses’ such as dining & entertainment, clothing, personal items etc. also come out of the same account, even when it’s used to pay your outstanding credit card balance. As a result, ‘overspending’ becomes easy to do and confusing to track.

Once you deposit your paycheck into your checking account, pay yourself first by depositing the amount you need to invest to reach your financial goal, directly into your ‘investment account.’

Next, use the STEP 3: Cash Flow calculator to determine the ‘mandatory’ bills you have. Leave the amount you need to pay your ‘mandatory’ expenses in your ‘checking’ account.

The amount that remains for ‘discretionary’ (fun) expenses may be transferred into your ‘spending’ account at the other bank. In fact, this account will serve as your monthly ‘spending allowance’ that you should not exceed. Be sure to keep extra funds in the ‘mandatory bills checking’ account at ALL times in case you experience some unforeseen expenses.

In summary, you’ve created 3 separate accounts: 1. Investment acccount for investments, 2. Checking account for mandatory bills and 3. A separate Checking account for discretionary (fun) expenses. It feels good to be in control doesn’t it? Let’s move on…

4. It’s time to invest!

Okay, so you’ve set a financial goal; you’ve determined your monthly expenses and how much you’re able to save to invest; you also learned how to control your cash flow by separating your checking account from your spending account. What should you do with this pre-determined monthly amount you’re able to invest?

Using the example above of $610, this amount should be deposited into your investment account with pre-authorized contributions so that you don’t get a chance to spend it. Doing so will allow you to invest consistently every month as though it were a bill. If you can invest more than the minimum amount to reach your financial goal then by all means do it!

With convenient access to online wealth management services, the opportunity to grow your wealth at significantly lower costs than what traditional banks and mutual funds offer has never been greater. A prime example of such a service includes Wealthsimple.

Either way, the take-home message is that getting started with investing is better than doing nothing! Each month you delay investing further delays your path to prosperity. As your wealth continues to grow, the income you earn from your investments as interest or dividends can eventually be used as your supplemental income…but never touch your principal (the original amount invested that is separate from any earnings accrued)!

5. Debt…the reason this strategy won’t work!

Although the solowealth Cash Flow Strategy is a logical answer to a common problem…debt is it’s kryptonite! No matter how much you earn, even if it’s in the millions, you’re not truly wealthy if debts and liabilities dominate your Net Worth. That’s why some celebrities and athletes once worth millions are now broke! Please note the following examples:

Consider the following tips to simplify debt management:

- For every dollar you earn, try to set aside at least 5% of your income for emergency cash savings in a high interest savings account and at least 15% of your income toward an investment account [Step 4 of the solowealth Financial Plan]. If an unforeseen emergency requires you to tap into your emergency savings account, refuel the account at the first chance you get. This total “pay yourself first” amount of 20%, should be made with pre-authorized contributions [PACs]. Once this 20% “automatic” contribution has been made, then use the remaining 80% of your income for your other expense categories: Residence, Transportation, Personal, Health & Insurance and Debts.

- You should pay off your credit card balance in full within every billing period and you should never resort to making minimum payments. Remember, every dollar paid in interest should have been an extra dollar in your pocket. If you can’t follow this simple principle, you have no business owning a credit card. Also, use your credit card only for “mandatory” expenses such as, gas, fixed bills, groceries etc. For “optional” expenses such as dining, entertainment and shopping for clothes, use cash or debit whenever possible.

- The debt category should be eliminated to and fixed at $0. There are a few exceptions to the rule such as home financing, a business loan or a student loan, all of which are meant to provide you with a return on your investment [ROI], but should still be paid off as soon as possible. Financing for a fancier car, jewelry or other luxury items is inexcusable if you can pay cash for more modest options.

Follow these 5 principles of the solowealth Cash Flow Strategy and you may have 99 problems, but financial won’t be one!