Why is it so important to have good credit?

Your credit score is like the Sun in your financial universe. If you have no credit history or a poor credit score, you’re shutting the doors to a world of financial opportunities. Benefits of having good credit include:

- Save more money with better loan rates & terms

- Higher approval rates and more negotiating power to finance a home, vehicle, or my personal favorite – borrowing to invest and grow your wealth.

- Some employers require credit checks. Don’t let a poor credit score get in the way of your success.

- Approval for “VIP Credit Cards” that come with special perks. Let’s face it, not only does it feel good to carry the exclusive cards in your wallet or purse, it automatically draws attention and respect because it says: “I got my s*it together!”

- All in all, to live a comfortable life.

So How Do You Build and Protect a Credit Score You Can Be Proud Of?

STEP 1: Know your Credit Score

Find out where you credit score stands today, then follow the next steps to BOOST your credit score. Here’s how to get your FICO credit score for FREE:

- Discover’s free Credit Scorecard. You don’t have to be a Discover cardmember to check your score.

- freecreditscore.com

- Your bank app may also include free monthly credit score updates. Find out if your bank offers this feature.

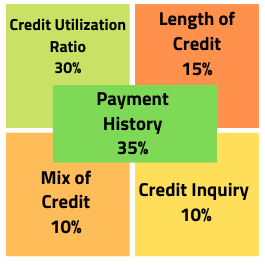

STEP 2: Know What Factors Affect Your Credit Score

The factors impacting your credit score are weighted differently as noted above.

- 35%, History of Payment – Pay your bills or any other financial obligations ON TIME, no matter how big or small the bill. If you’re forgetful, automate your payments and don’t be late by even a single day. Your history of payment is tracked.

- 30%, Credit Utilization Ratio – This is the percentage of your available credit that you’re using. Did you know that using more than 70% of your total available credit can actually hurt your score? It makes it seem like you depend too much on credit for your day-to-day expenses which places you in a higher credit-risk category. Try not to use more than 30% of your available credit. If you do, then consider making payments twice a month: one payment just before the statement closing date to reduce the balance that the credit bureaus will see and the second payment just before the due date to avoid paying any interest or late fee.

- 15%, Length of Credit – Don’t close any open credit accounts since a longer history of credit plays to your advantage to establish your credit score.

- 10%, Mix of Credit – Besides credit cards, having other forms of credit such as a small personal loan can build your credit but only if you’re 100% sure that you can meet your payment obligations as proof of your creditworthiness.

- 10%, Credit Inquiry – your credit score can take a temporary hit when a financial institution makes a “hard check” to access your credit report when making a lending decision, such as a credit card application, mortgage and even obtaining a new phone plan. This is unlike a “soft check” such as checking your own credit score, which does NOT impact your score.

STEP 3: One of the Easiest Ways to Build Credit is With a Credit Card.

How do you establish credit using a credit card, but without going into credit card debt? Download the following guide to learn why the Credit Builder Card is the easiest way to build your credit.

Contrary to popular belief, you don’t need to hire a credit repair agency for something that you can easily accomplish ‘solo.’ All you need is a strategy that works, just like following a recipe. With patience, diligence and a plan of action, an exciting world of financial opportunities awaits you.

Once you accomplish your mission to build great credit, you can stop using the Credit Builder Card and apply for a credit card of your choice. Just be sure to review the article, HOW I USE MY CREDIT CARD WITH NO CREDIT CARD DEBT, to learn how to MAINTAIN great credit and avoid the debt trap for good.

In summary:

- Review your credit score & report at least twice a year. Report any incorrect information to the credit bureau ASAP.

- Pay ALL of your bills in-full and on-time, including your credit card bill.

- Try not to use more than 30% of your available credit. Example: For every $1000 of available credit, try not to use more than $300.

- Don’t apply for too much NEW credit in a short amount of time.

- Apply for a secured credit card such as the Credit Builder Card, to help you build credit in a way that won’t get you into debt.

- PAY OFF DEBT and stay out of debt! Step 3 of the solowealth Financial Plan: Cash Flow, can help you do just that.